More than the sum of its parts

Billogram isn’t just a combination of payment solutions, financial systems, and debt collection. It adds intelligent functionality that creates real value across the entire Invoice-to-Cash process.

Results that speak for themselves

20%

more invoices paid on time

80%

reduction in customer service cases

300+

customers

100+

employees

14

markets

Differences that make a difference...

Product capabilities & technology

| Feature | Billogram | Other solutions |

|---|---|---|

Feature Comprehensive solution | Billogram Yes – from invoicing to debt collection and reporting | Other solutions Often fragmented services |

Feature Specialization | Billogram Focused on recurring billing | Other solutions General solutions for broader needs |

Feature Customization | Billogram High level of flexibility and personalization | Other solutions Standardized processes |

Feature API & integrations | Billogram Robust, real-time data | Other solutions Varies, sometimes limited |

Feature AI & machine learning | Billogram AI-driven customer support and optimized dunning flows with machine learning | Other solutions Manual handling and standardized processes |

Market fit and business alignment

| Feature | Billogram | Other solutions |

|---|---|---|

Feature Industry focus | Billogram Telecom/broadband, energy, insurance, mobility/parking | Other solutions General or e-commerce-focused solutions |

Feature Business model & incentives | Billogram Focused on timely payments over profit from reminders or debt collection | Other solutions Revenue from late fees and collection services |

Feature Scalability & market expansion | Billogram One unified Invoice-to-Cash platform for multiple markets | Other solutions Often country-specific, requiring multiple providers |

Feature B2B & B2C compatibility | Billogram Handles both business and consumer invoicing | Other solutions Often limited to one segment |

Long-term value and compliance

| Feature | Billogram | Other solutions |

|---|---|---|

Feature Future-proof & scalable | Billogram Supports long-term growth & regulatory changes | Other solutions Often rigid, requiring frequent system upgrades |

Feature Compliance | Billogram Meets evolving EU and local regulations | Other solutions May require separate compliance solutions |

We don’t fit in and that’s the point

Companies often look for solutions within specific categories, such as:

Fintech Solutions - Fast payment flows but little focus on long-term customer relationships.

Financial Systems - Comprehensive features, but often complex and difficult to customize.

Debt Collection Services - Focused on recovery, with limited tools to improve payment rates before the due date.

Billogram combines the best of these worlds with a unique ability to handle recurring billing while strengthening customer relationships. We don’t fit into a single category - we offer something entirely different.

Results you can count on

80% fewer debt collection cases – Powered by AI-driven dunning and smart collections.

75% digital invoicing conversion – Achieved through automated and personalized features.

40% reduction in customer service cases – Thanks to transparent payment flows and real-time updates.

Ready to see the difference?

Let’s talk about how Billogram can turn your invoicing into a strategic asset.

Explore more platform features

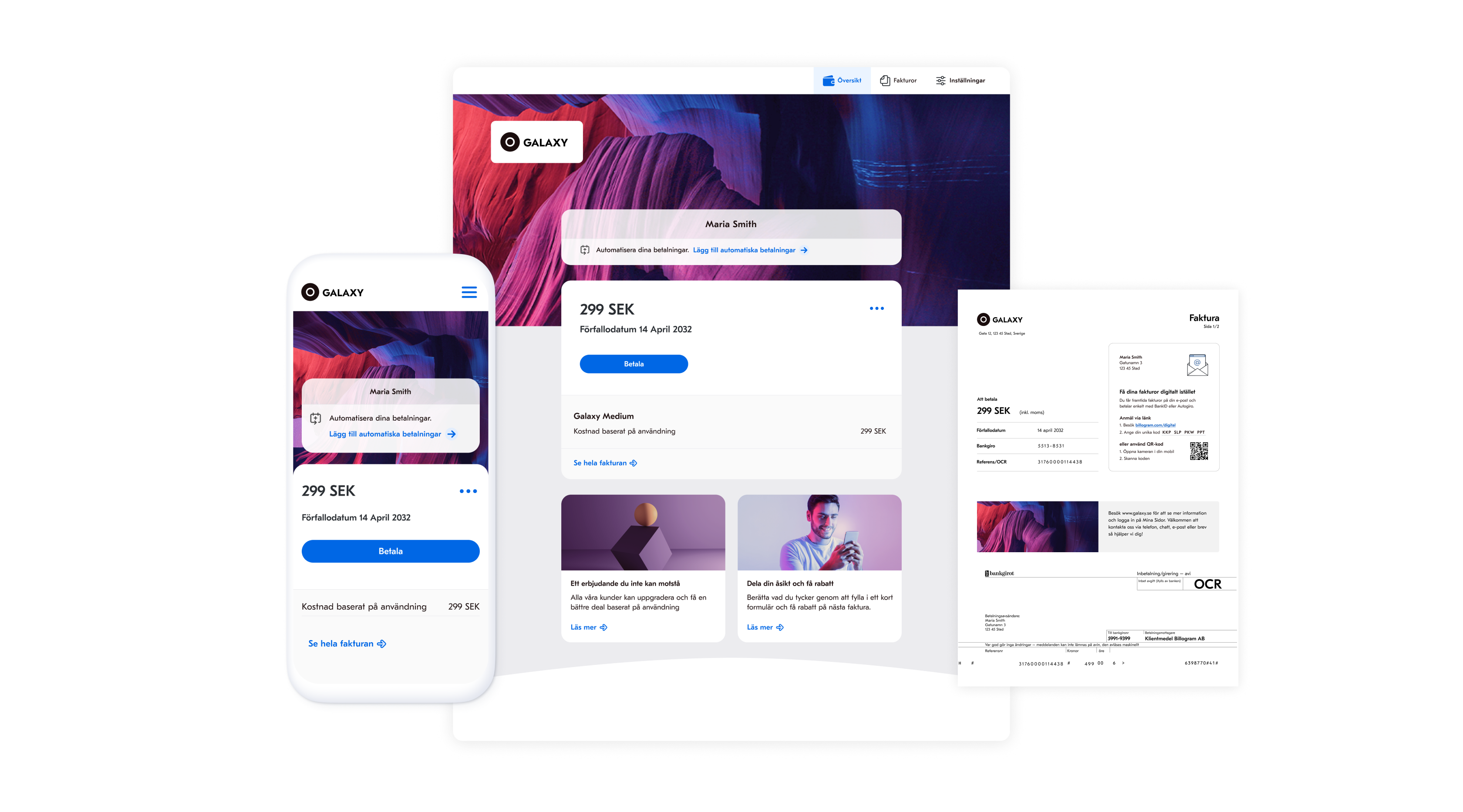

Billogram is more than just an invoicing solution. By consolidating the entire process into a cloud-based service, we not only add innovative features but also deliver value throughout the entire invoice-to-cash chain.

Your guide to a painless implementation

Modernizing and future-proofing the billing and payment process is often a more straightforward project than one might think. The right type of integration and a supplier who can flexibly realize your vision, based on your conditions, is truly a winning combination!

It has become easier for our customers to receive, understand, and pay their invoices. The fact that more people pay on time has also improved our cash flow in the business.

Group CFO at Sector Alarm

FAQ

Comparison and benefits

- What makes Billogram unique compared to other invoicing and payment solutions?

Billogram is specifically designed for recurring payments and is used by companies in telecom, energy, parking, broadband, and insurance. Unlike general invoicing systems or PSPs for e-commerce, we have optimized the entire Invoice-to-Cash process for businesses with large customer volumes and recurring revenue models.

- How does Billogram work with our existing ERP system?

Billogram complements ERP systems by receiving invoice data and managing the entire invoice-to-cash process, from invoice distribution to payment and debt collection. We eliminate manual steps and make the payment flow efficient and automated while allowing the ERP system to continue handling accounting and finance.

- What does it mean that Billogram is a PSP (Payment Service Provider)?

Billogram is a PSP-licensed payment service provider that handles payments directly, which means that we:

Are supervised by the Financial Supervisory Authority and meet high standards of security and regulatory compliance.

Enable scalable payments in multiple European countries, supporting local payment methods and currencies.

Integrate payment directly into the invoice, providing a seamless payment experience for the customer and reducing churn.

- How does Billogram differ from printing partners and traditional invoicing providers?

Many invoicing providers only offer printing and distribution of paper invoices, while Billogram focuses on digital invoicing and integrated payments. We help businesses increase the share of digital payments and direct debit, reducing administration and improving cash flow.

- How does Billogram differ from PSPs targeting e-commerce and direct payments?

Unlike PSPs that focus on card payments and one-time purchases in e-commerce, Billogram is optimized for recurring payments and automated invoicing flows. We handle direct debit, automated withdrawals, and flexible payment solutions, which are essential for businesses with subscription-based and industry-specific business models.

- How does Billogram differ from debt collection agencies?

Many debt collection agencies make money from reminder fees and collection cases, while Billogram is designed to prevent late payments. With Smart Dunning, interactive invoices, and customized due date reminders, we help businesses get paid on time – without damaging customer relationships.

Ready to take your invoicing to the next level?

Let us show you how Billogram can help your company grow.

Ready to streamline invoicing and payments?

Let’s talk possibilities

Fill out the form and we’ll be in touch!